Not since the Great Recession (2007 - 2009), and maybe the Great Depression (1929 - 1939), has the need for financial literacy been more critical.

Author: R. Michael Brown

Financial Literacy

Published:

Friday, 01 May 2020

Sharing

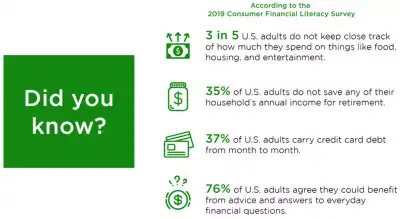

Not since the Great Recession (2007 - 2009), and maybe the Great Depression (1929 - 1939), has the need for financial literacy been more critical. The news is everywhere:

As COVID-19 Crashes the Economy, Workers and Business Owners Wonder if Anything Can Save Them from Financial Ruin (Time Magazine)

Events and Market Volatility Related to COVID-19 Leads to Troubling Financial Impact for Majority of Respondents (Yahoo Finance)

U.S. Personal Finances: Future More Concerning Than Present (Gallup Poll)

EDITORIAL: Personal Finance Could Be Most Important Course that a Student Ever Takes (York Dispatch)

The No. 1 Personal Finance Lesson to Take Away from the Coronavirus (CNBC)

“Even after more than a decade since the financial crisis, Americans still receive a ‘failing grade’ on overall financial knowledge, says one study author, with the average number of questions answered correctly barely above 50%.”

“78% of American workers live paycheck-to-paycheck,” said Dave Ramsey, the well-known personal finance guru. “And 69% have less than $1,000 in savings. Living like this and playing around with debt is a recipe for disaster. You can’t get ahead that way.”

The Wall Street Journal, in the midst of the COVID-19 crisis, launched a personal finance website called WSJ Money which has a Q&A format and that’s great; but, if users don’t have the fundamental knowledge about how to handle money and an education in financial literacy, no website will really help them.

“Parents tell me all the time that they wish they could participate in a JA program,” said Claudia Kirk Barto, President of Junior Achievement of the Palm Beaches & Treasure Coast. “We want to be part of the solution by offering financial literacy programs in concert with the curriculum.”

Financial Literacy is a pillar in Junior Achievement. Twelve Kindergarten through High School JA programs teach the role of money in our lives: how to earn, save, invest, donate, and spend it. The programs focus on personal and business finance.

The programs are free to schools, funded by generous donations from foundations, grants, and individual donors.

Teachers just need to contact JA and schedule the free programs. JA supplies the materials and, in most cases, the volunteers to teach the curriculum. Teachers are encouraged to contact JA today and book programs for classes in the 2020 - 2021 school year.

In the near term for the rest of this school year, many of the programs and materials are offered digitally through JA’s Google Classrooms.

“Families were not prepared for the financial impact of COVID-19,” said Barto. “We want to prepare our students to be ready for anything!”

Image caption: Quicken Survey

Here is what is offered, many are available as virtual online programs and activities.

JA Programs Included in the Financial Literacy Pillar

JA Ourselves® introduces students to personal economics and the choices consumers make to meet their needs and wants. Students learn about the role of money in society and gain practical information about earning, saving, and sharing money. (Grade K)

JA Our Families® introduces students to the concepts of families, neighborhoods, money, and needs and wants. Students explore the ways in which businesses provide goods, services, and jobs for families. (Grade 1)

JA Our Community® introduces students to work readiness and early elementary grades social studies learning objectives, including how citizens benefit from and contribute to a community’s success. Introduces taxes. (Grade 2)

JA Our City® introduces students to the choices people have with money. Students learn about the importance of economic exchange in a city and how entrepreneurs promote a healthy economy. (Grade 3)

JA Our Region® introduces students to the intersection of entrepreneurship and upper elementary grades social studies learning objectives. Students are provided with a practical approach to starting a business, including finance. (Grade 4)

JA More than Money® teaches students about money-management, goods and services, and global markets. Students learn a practical approach to starting a business and making smart decisions about managing money. (Grades 3–5, also after-school)

JA BizTown® combines in-class learning with a day-long visit to a simulated, fully interactive town where JA BizTown citizens make then connection between what they learn in school and the real world. (Grades 4–6)

JA Global Marketplace® demonstrates why and how countries buy and sell from each other. Students examine the interconnection between producers and consumers in the global marketplace and the effect of free enterprise in an economic system. (Grades 6–8)

JA Finance Park Virtual® builds a foundation on which students can make intelligent lifelong financial decisions, including those related to income, expenses, saving, and credit. The program culminates in a hands-on budgeting simulation on an online virtual site. (Grades 7–12)

JA Personal Finance® demonstrates the interrelationship between today’s financial decisions and future financial freedom. Money-management strategies include earning, employment and income, budgeting, savings, credit and debt, consumer protection, smart shopping, risk management, and investing. (Grades 9–12)

JA Economics® connects students to the economic principles that influence their daily lives, as well as their futures. (Grades 9–12)

JA Financial Literacy™ equips students with foundational personal finance skills such as how to earn and save money; how to manage money and bank accounts, investments, and credit; how to assess risks and use insurance; and how to address financial problems like identity theft and debt. (Grades 9–12)

Click to Learn More About These Programs

Teachers! Contact us to schedule your programs for the 2020 – 2021 school year!

Elementary School Virtual and In-Classroom Programs

Sandy Salazar, Elementary School Program Manager SSalazar@JuniorAchievement.com

Middle & High School Virtual and In-Classroom Programs

Katie Spitzig, Middle & High School Program Manager KSpitzig@JuniorAchievement.com

JA BizTown

Jaisa Godwin, JA BizTown Program Manager JGodwin@JuniorAchievement.com