Author: Julia Latchana

Financial Literacy

Published:

Tuesday, 01 Jun 2021

Sharing

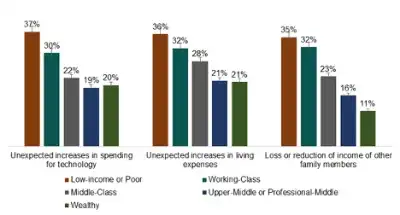

Image caption: Financial Unpreparedness Statistics

The COVID-19 Pandemic came with unexpected effects, like lockdown closing workplaces and a lot of expenses.

According to a gradSERU COVID-19 Survey, for graduate and professional students, some of these unexpected expenses included increases in technology spending, living expenses, and loss or reduction of incomes for family members.

However, a 2019 AARP survey showed that 53% of U.S. households have no emergency savings account for unexpected financial expenses, like the COVID-19 Pandemic. This means that most of the unexpected expenses that people faced could not be covered.

Junior Achievement of the Palm Beaches and Treasure Coast offers programs that teach students about budgeting, savings, and more.

Contact Kspitzig@juniorachievement.com today to incorporate JA programs into your classroom.

Unexpected Technology Spending Increases

- 37% Low-income or Poor

- 30% Working-Class

- 22% Middle-Class

- 19% Upper-Middle or Professional Middle

- 20% Wealthy

Unexpected Increases in Living Expenses

- 36% Low-income or Poor

- 32% Working-Class

- 28% Middle-Class

- 21% Upper-Middle or Professional Middle

- 21% Wealthy

Loss or Reduction of Income of Other Family Members

- 35% Low-income or Poor

- 32% Working-Class

- 23% Middle-Class

- 16% Upper-Middle or Professional Middle

- 11% Wealthy